These industry-specific factors definitely matter when it comes to assessing D/E. The other important context here is that utility companies are often natural monopolies. As a result, there’s little chance the company will be displaced by a competitor. The investor has not accounted for the fact that the utility company receives a consistent and durable stream of income, so is likely able to afford its debt. When assessing D/E, it’s also important to understand the factors affecting the company.

Cheaper Than Equity Financing

Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known.

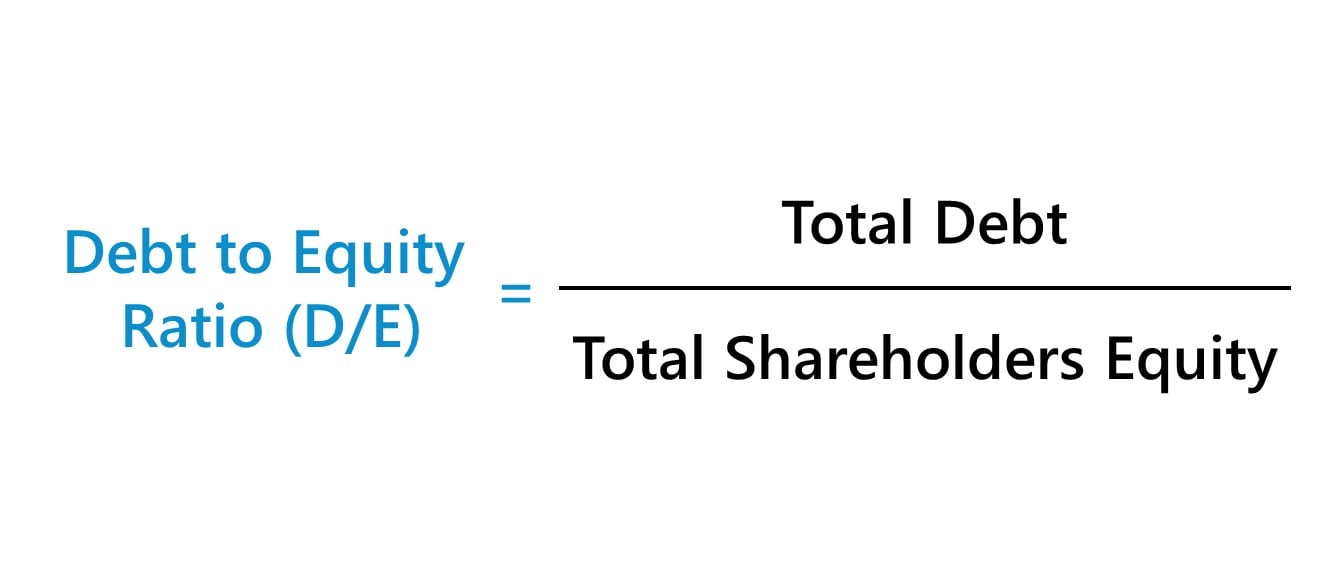

Debt-to-Equity Ratio Formula

Replaces your mortgage with a new loan for a larger amount, cashing out the difference. Borrowing when your income is unstable, which increases the risk of defaulting and potentially losing your home. Paying for emergency medical expenses that would otherwise lead to high-interest debt, ensuring financial stability.

Debt Ratio: Interpreting, Calculating, and Optimizing Financial Health

This usually happens when a company is losing money and is not generating enough cash flow to cover its debts. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky.

Ready to Streamline Your Financial Management?

Quick assets are those most liquid current assets that can quickly be converted into cash. These assets include cash and cash equivalents, marketable securities, and net accounts receivable. Different industries vary in D/E ratios because some industries may have intensive capital compared to others. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio. Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix.

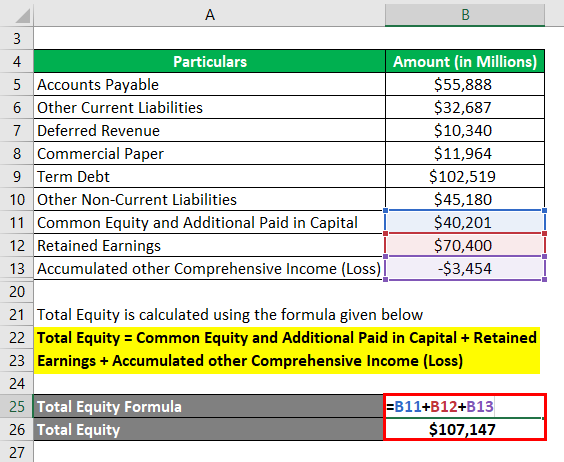

How to Calculate the Debt to Equity Ratio

- Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company.

- The personal D/E ratio is often used when an individual or a small business is applying for a loan.

- These fees are usually rolled into your loan, increasing the total cost you’ll need to repay.

- Use this calculator during financial reviews, investment analysis, or when assessing a company’s ability to meet its financial obligations.

- Enjoy a free month of expert bookkeeping and focus on growth, not numbers.

It will flag off the lenders who are considering investing in a company as it also indicates a high level of risk. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good. Additionally, the ratio should be analyzed with other financial metrics and qualitative factors to get a comprehensive view of the company’s financial health. This number represents the residual interest in the company’s assets after deducting liabilities. If a company takes out a loan for $100,000, then we would expect its D/E ratio to increase. Our company now has $500,000 in liabilities and still has $600,000 in shareholders’ equity.

However, an ideal D/E ratio varies depending on the nature of the business and its industry because there are some industries that are more capital-intensive than others. The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. The cash ratio compares the cash and other liquid assets of a company to its current liability. This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets.

For purposes of simplicity, the liabilities on our balance sheet are only short-term and long-term debt. In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). Determining whether a debt-to-equity ratio is high or low can be tricky, as it heavily depends on the industry. Just because you can borrow up to $170,000 doesn’t mean you’ll automatically qualify for the full amount. Lenders also consider other factors, such as your credit score, debt-to-income ratio and employment history. For instance, if your debt-to-income ratio is too high or your credit score is below their preferred threshold, they may reduce your loan amount.

A Debt to Equity Ratio greater than 1 indicates that a company has more debt than equity. This situation typically means that the company has been aggressive in financing its growth with debt. This can be beneficial during times of low-interest rates or when profits generated from borrowed funds exceed the cost of debt. production costs: what they are and how to calculate them However, it can also increase the company’s vulnerability to economic downturns or rising interest rates, as the obligation to service debt remains in good and bad economic times. A lower debt-to-equity ratio means that investors (stockholders) fund more of the company’s assets than creditors (e.g., bank loans) do.

In contrast, a company with a low ratio is more conservative, which might be more suitable for its industry or stage of development. Considering the company’s context and specific circumstances when interpreting this ratio is essential, which brings us to the next question. On the other hand, a company with a very low D/E ratio should consider issuing debt if it needs additional cash. If a bank is deciding to give this company a loan, it will see this high D/E ratio and will only offer debt with a higher interest rate in order to be compensated for the risk. The interest payments will be higher on this new round of debt and may get to the point where the business isn’t making enough profit to cover its interest payments. The cash ratio provides an estimate of the ability of a company to pay off its short-term debt.

A higher ratio indicates to the investors and the lenders that the company is at a higher risk. When you are running a business, you will have to revisit your finances from time to time to get a perspective on its financial health. As explained above, the debt to equity ratio calculator will come in handy when you want to apply for a fresh loan. With the information given above, you can calculate the D/E ratio for your business for more clarity. The debt-to-equity ratio (D/E) measures the amount of liability or debt on a company’s balance sheet relative to the amount of shareholders’ equity on the balance sheet. D/E calculates the amount of leverage a company has, and the higher liabilities are relative to shareholders’ equity, the more leveraged the company is.