This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors. As a business, the practice can also help you manage your cash flow and spot any inefficiencies. It is a general practice for businesses to create their balance sheet at the end of the financial year, as it denotes the state of finances for that period. However, you need to record financial transactions throughout the year in the general ledger to be able to put together the balance sheet. Account reconciliation is an important accounting process as the entries in the general ledger may not always be accurate. For instance, when you receive a check from a customer, you may have recorded it as paid.

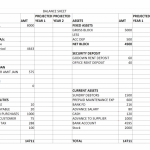

Double-Entry Accounting Example

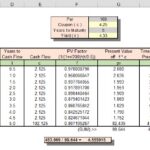

After scrutinizing the account, the accountant detects an accounting error that omitted a zero when recording entries. Rectifying the error brings the current revenue to $90 million, which is relatively close to the projection. For example, a company can estimate the amount of expected bad debts in the receivable account to see if it is close to the balance in the allowance for doubtful accounts. The expected bad debts are estimated based on the historical activity levels of the bad debts allowance. The frequency of your reconciliation process can be determined by the size and type of business.

Additionally, reconciling accounts on time consistently is also essential to maintaining financial integrity. If the indirect method is used, the cash flow from the operations section is already presented as a reconciliation of the three financial statements. Other reconciliations turn non-GAAP measures, such as earnings before interest, taxes, depreciation, and amortization (EBITDA), into their GAAP-approved counterparts.

- Whether it’s reconciling bank statements, vendor accounts, or intercompany transactions, each type plays a pivotal role in ensuring that records are consistent and errors are promptly identified and corrected.

- If you’ve written a check to a vendor and reduced your account balance in your internal systems accordingly, your bank might show a higher balance until the check hits your account.

- And if you never reconcile your accounts, chances are that fraudulent activity will continue.

- For example, real estate investment company ABC purchases approximately five buildings per fiscal year based on previous activity levels.

- This process involves reconciling credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, and subscriptions to ensure that all are properly accounted for and balanced.

We and our partners process data to provide:

Invoice reconciliation usually involves two-way matching or three-way matching, which compares invoice details against a purchase order and shipping receipt. Once you have access to all the necessary records, you need to reconcile, or compare, the internal trust account’s ledger to individual client ledgers. Businesses and companies need to conduct reconciliation to ensure the consistency and accuracy of financial accounts and records within the business. The most common of both, the Documentation review method involves collating the account details of multiple accounts or statements and reviewing the consistency, appropriateness, or accuracy of each transaction.

Ensure regular and timely reconciliation

Take my word for it, you don’t want to skip this process, even for a single month. Learn which general ledger accounts should be reconciled regularly, and key things to look for during the account reconciliation process. With real-time accrued vs deferred revenue reconciliation capabilities, HighRadius ensures that your financial records are updated daily.

Find direct deposits and account credits that appear in the cash book but not in the bank statement, and add them to the bank statement balance. Similarly, if there are deposits appearing in the bank statement but are not in the cash book, add the entries to the cash book balance. The bank discovered that the mysterious transaction was a bank error, and therefore, reimbursed the company for the incorrect deductions. Rectifying the bank errors bring the bank statement balance and the cash book balance into an agreement. These charges include uncleared checks, internally recorded auto-payments that have not been deducted, ATM service charges, insufficient funds (NSF) charges, overdraft charges, or over-limit fees, among others. You then subtract these from your bank statement balance where they have not been reflected.

For the legal profession, however, regular, effective reconciliation in accounting is key to maintaining both financial accuracy and legal compliance—especially when managing trust accounts. Next, you check that all incoming funds have been reflected in both your internal records and your bank account statement. You identify deposits and account credits that are yet to be recorded by the bank in the bank statement and add these to the statement balance. Account reconciliation is an accounting process, usually embarked on at the end of an accounting period, that makes sure financial accounting records are consistent and accurate. Generally done for general ledgers, account reconciliation involves the comparison of two independent but related records to make sure that what is considered long arms transactions and balances correspond with each other. To ensure accuracy and balance, the process of account reconciliation involves comparing the balances of general ledger accounts with the supporting sets of data sources, such as bank statements, invoices, and receipts.

One of the most important things you can do to keep your general ledger accurate is to perform a bank reconciliation monthly. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When conducting a reconciliation at the end of the month, the accountant noticed that the company undercapitalization: definition causes and examples was charged ten times for a transaction that was not in the cash book. The accountant contacted the bank to get information on the mysterious transaction. The account conversion method is where business records such as receipts or canceled checks are simply compared with the entries in the general ledger.